Quadratic programming problems can be solved with “

Example

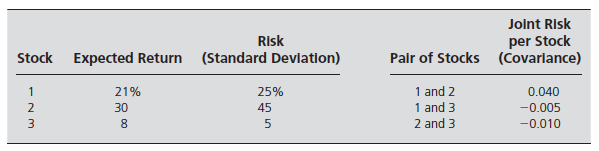

Let’s figure out how to do it with an example of “Applying Nonlinear Programming to Portfolio Selection”:

Please note that, this example involves three variables (x1, x2, and x3). If you want an example of two variables (x1 and x2), please check my another post: Another Quadratic Programming Example with R.

“It now is common practice for professional managers of large stock portfolios to use computer models based partially on nonlinear programming to guide them. Because investors are concerned about both the expected return (gain) and the risk associated with their investments, nonlinear programming is used to determine a portfolio that, under certain assumptions, provides an optimal trade-off between these two factors.”

Frederick & Mark (2014, p.283)

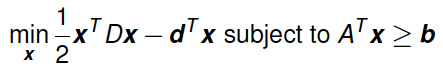

Matrix Notation

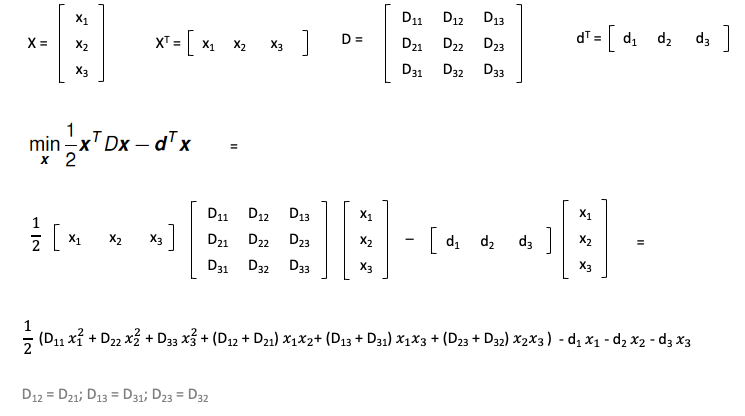

First, let’s consider a general matrix notation for three variables: x1, x2, x3:

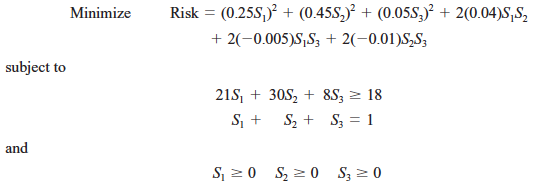

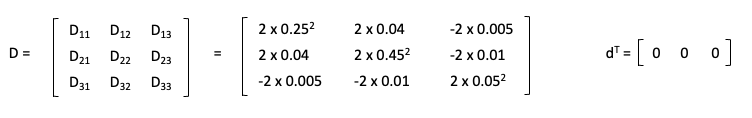

Second, the matrix of D and the vector of d can be found by the parameter mapping to the example:

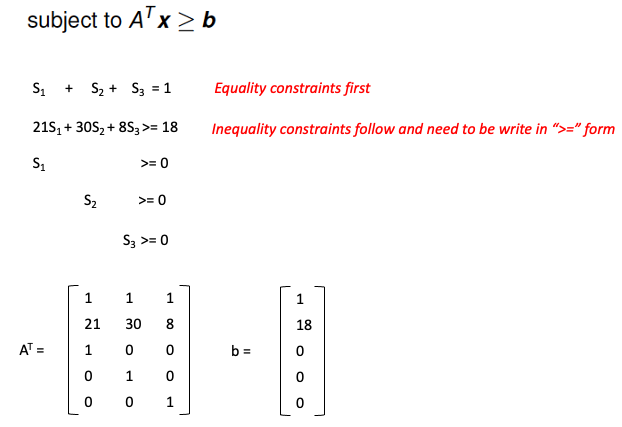

Similarly, the constraint matrix can be found as follows:

Please note that, for the constraints matrix, we need to put equality constraints first and rewrite inequality constraints in “>=” form.

Package quadprog Usage

solve.QP(Dmat, dvec, Amat, bvec, meq=0, factorized=FALSE)

- Dmat

matrix appearing in the quadratic function to be minimized.

- dvec

vector appearing in the quadratic function to be minimized.

- Amat

matrix defining the constraints under which we want to minimize the quadratic function.

- bvec

vector holding the values of b_0 (defaults to zero).

- meq

the first meq constraints are treated as equality constraints, all further as inequality constraints (defaults to 0).

- factorized

logical flag: if TRUE, then we are passing R^(-1) (where D = R^T R) instead of the matrix D in the argument Dmat.

Code & Output

# Load "quadprog" package

# library(quadprog)

# Matrix appearing in the quadratic function

Dmat <- matrix(c(0.125, 0.08, -0.01, 0.08, 0.405, -0.02, -0.01, -0.02, 0.005), 3, 3)

# Vector appearing in the quadratic function

dvec <- c(0, 0, 0)

# Matrix defining the constraints

Amat <- t(matrix(c(1, 21, 1, 0, 0, 1, 30, 0, 1, 0, 1, 8, 0, 0, 1), 5, 3))

# Vector holding the value of b_0

bvec <- c(1, 18, 0, 0, 0)

# meq indicates how many constraints are equality

# Only the first constraint is equality so meq = 1

qp <- solve.QP(Dmat, dvec, Amat, bvec, meq = 1)

qp

$solution

[1] 0.4019549 0.2170267 0.3810185

$value

[1] 0.02379223

$unconstrained.solution

[1] 0 0 0

$iterations

[1] 3 0

$Lagrangian

[1] -0.049686557 0.005403946 0.000000000 0.000000000 0.000000000

$iact

[1] 1 2

As you can see, the portfolio selection of these three stocks should be qp$solution (40.2% Stock1, 21.7% Stock2, and 38.1% Stock3) and the total risk is $qp$value, 2.4%.

Looking for an example of two variables (x1 and x2)? Please also check my another post: Another Quadratic Programming Example with R.

Hi Henry,

Thanks a lot for the example. Could you please mention how you went about constructing the matrices Dmat and Amat. I am having hard time understanding the matrix construction. Thanks.

Hi pranay,

Sorry for the late reply. I updated the post with the steps to extract the matrices.

Hope it helps and please let me know if something is not clear.

Thanks,

Henry

that was perfect Henry.

thanks a lot